Use the following information to answer the question(s) below.

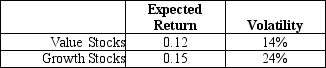

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Cash Inflow

The receipt of cash or cash equivalents into a business from various sources, such as sales, financing, or investments.

Indirect Method

A cash flow statement preparation method that adjusts net income for non-cash transactions and changes in working capital to calculate cash flow from operating activities.

Accounts Payable

Liabilities owed to vendors or suppliers for goods or services received that haven't been paid for yet.

Net Income

It refers to the bottom line of a company's income statement, indicating the earnings after all deductions.

Q4: Suppose you plan to hold Von Bora

Q12: The risk premium for "Meenie" is closest

Q14: Which of the following statements is FALSE?<br>A)

Q25: Which of the following statements is FALSE?<br>A)

Q31: Based upon the enterprise value to EBITDA

Q50: What does the existence of a positive

Q58: Suppose that Monsters' expected return is 12%.Then

Q74: Assuming that Dewey's cost of capital is

Q93: If in the event of distress,the present

Q113: The beta for Sisyphean's new project is