Use the following information to answer the question(s) below.

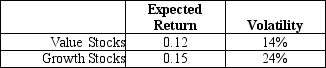

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Organic Material

Matter derived from living organisms, typically consisting of carbon-based compounds.

Breccia Pipe

A pipe- or cone-shaped structure filled with breccia; mostly formed by cave collapse, but can also form by igneous and hydrothermal processes.

Uranium Ore

A natural mineral from which uranium can be economically extracted for use in energy production and nuclear weapons.

Caldera

A large, basin-shaped volcanic depression more extensive than a crater, formed by the collapse of land following a volcanic eruption.

Q3: The term a<sub>s </sub>is a(n):<br>A) error term

Q15: Various trading strategies appear to offer non-zero

Q15: IF FBNA increases leverage so that its

Q24: In 2005,assuming an average dividend payout ratio

Q29: The standard deviation for the return on

Q29: Which of the following statements is FALSE?<br>A)

Q46: The cost of capital for the oil

Q59: The payback period for project A is

Q71: The free cash flow from Shepard Industries

Q98: Assuming that Tom wants to maintain the