Use the following information to answer the question(s) below.

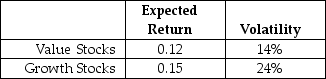

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk free rate is 3.5%.

The risk free rate is 3.5%.

-Which of the following is NOT an assumption used in deriving the Capital Asset Pricing Model (CAPM) ?

Definitions:

Rule of 72

A mathematical rule to estimate the number of years required to double an investment at a given annual fixed interest rate.

$10,000

A numerical figure representing a specific amount of money, notable in various financial contexts.

Cash Flows

signify the net amount of cash being transferred into and out of a business, crucial for assessing liquidity, flexibility, and overall financial health.

Net Present Value

A financial metric that calculates the value of a series of cash flows by discounting them to their present value, used to assess the profitability of investments.

Q9: Nielson Motors plans to issue 10-year bonds

Q23: The incremental cash flow that the Krusty

Q23: Which of the following statements is FALSE?<br>A)

Q27: Which of the following statements is FALSE?<br>A)

Q48: Consider the following list of projects:<br> <img

Q54: Consider the following formula: τ* = <img

Q70: Assume that in the event of default,20%

Q80: KAHR Incorporated will have EBIT this coming

Q115: Which of the following statements is FALSE?<br>A)

Q125: Suppose over the next year Ball has