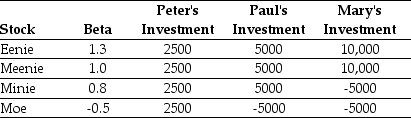

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's portfolio is closest to:

Definitions:

Allowance Account

An account used to adjust the carrying value of accounts receivable to the amount expected to be collected.

Contra Account

An account used in conjunction with another account to adjust or offset its balance.

Allowance Account

An account set aside to cover potential losses from doubtful accounts, reflecting estimated uncollectible receivables.

Statement of Financial Position

A financial report detailing a company's assets, liabilities, and equity at a specific point in time, commonly known as a balance sheet.

Q22: Common risk is also called:<br>A) diversifiable risk.<br>B)

Q43: Assuming that Tom wants to maintain the

Q54: Assuming that Palin's cost of capital is

Q61: Two separate firms are considering investing in

Q64: Suppose that Luther's beta is 0.9.If the

Q64: Suppose that to raise the funds for

Q66: Which of the following statements is FALSE?<br>A)

Q83: The NPV for the trucking division is

Q93: Luther's after-tax debt cost of capital is

Q133: The variance on a portfolio that is