Use the table for the question(s) below.

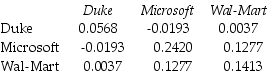

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Duke Energy and a $4000 investment in Wal-Mart stock is closest to:

Definitions:

Pretend

To act as if something is the case when in fact it is not, often used in imaginative or role-playing scenarios.

Symbols

Objects, characters, figures, or colors used to represent abstract ideas or concepts.

Concrete Operational Thought

A stage of cognitive development in children, as defined by Piaget, where they can think logically about concrete events but struggle with abstract concepts.

Sleep Terrors

Intense episodes of fear that occur during sleep, often accompanied by screaming, kicking, or panicking, without the sleeper fully waking up.

Q17: Kinston Industries just announced that it will

Q18: The market capitalization of d'Anconia Copper after

Q50: Which of the following statements is correct?<br>A)

Q55: If the discount rate for project B

Q66: The beta for the risk free investment

Q67: Which of the following statements is FALSE?<br>A)

Q83: Wyatt Oil has a bond issue outstanding

Q84: Luther Industries has a market capitalization of

Q95: Consider a portfolio consisting of only Microsoft

Q97: Following the borrowing of $12 and subsequent