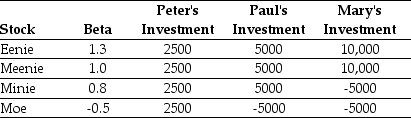

Use the table for the question(s)below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Explain how having different interest rates for borrowing and lending affects the CAPM and the SML.

Definitions:

Marginal Cost Curve

A graph showing the change in the cost of producing one more unit of a good as production levels change.

Short-Run Supply Curve

A graphical representation showing the quantity of goods a firm is willing to supply at different price levels in the short term, holding some inputs fixed.

Shutdown Point

The level of operation at which a firm's total revenue is equal to its total variable costs, below which the firm should cease production to minimize losses.

Point

A specific location or position in a spatial setting or within a set of data.

Q15: Various trading strategies appear to offer non-zero

Q22: Suppose the risk-free interest rate is 4%.If

Q26: Your estimate of the asset beta for

Q30: Which of the following statements is FALSE?<br>A)

Q34: Which of the following statements is FALSE?<br>A)

Q36: Which of the following agency problems represents

Q58: What is Luther's enterprise value?<br>A) $16 billion<br>B)

Q77: Assume the appropriate discount rate for this

Q82: The value of Shepard Industries without leverage

Q84: The present value of LCMS' interest tax