Use the following information to answer the question(s) below.

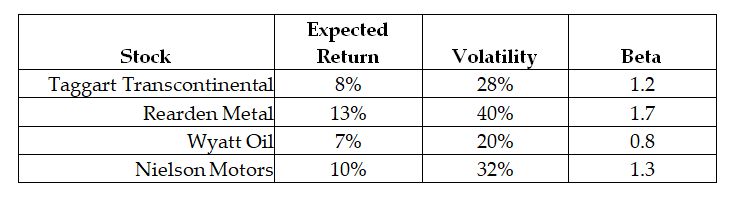

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Wyatt Oil is closest to:

Definitions:

Cash Inflow

The total amount of money being transferred into a business, often from operations, investments, or financing.

Issue Common Shares

The process by which a corporation sells new shares to investors to raise capital.

Ceases Operations

The process when a business stops its principal business activities and ends its operations.

Shareholders

Individuals or entities that own one or more shares of stock in a public or private corporation, holding an ownership stake.

Q3: The effective dividend tax rate for a

Q26: In 2000,assuming an average dividend payout ratio

Q33: The value of the oil exploration division

Q36: The Sisyphean Company is considering a new

Q44: LCMS' annual interest tax shield is closest

Q60: Suppose that you are holding a market

Q67: Which of the following statements is FALSE?<br>A)

Q67: Which of the following is NOT an

Q85: Consider the following equation: r<sub>wacc</sub> = <img

Q104: The Volatility on Stock Z's returns is