Use the table for the question(s) below.

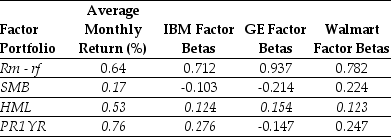

Consider the following information regarding the Fama-French-Carhart four factor model:

-Using the FFC four factor model and the historical average monthly returns,the expected monthly return for IBM is closest to:

Definitions:

Interest-Rate Risk

The potential for investment losses due to fluctuations in interest rates.

Yield To Maturity

The total return anticipated on a bond if held until its maturity date, taking into account its current market price, par value, coupon interest rate, and time to maturity.

Coupon Bond

A type of bond that pays the holder interest payments at fixed intervals until maturity, when the principal is repaid.

Q17: Which of the following methods are used

Q28: Nielson's equity cost of capital is closest

Q29: Which of the following statements is FALSE?<br>A)

Q32: Which of the following statements is FALSE?<br>A)

Q43: The overall value of Wyatt Oil (in

Q65: Suppose you are a shareholder in d'Anconia

Q77: Your firm is planning to invest in

Q82: Which of the following statements is FALSE?<br>A)

Q86: Which of the following is true of

Q91: Which of the following statements is FALSE?<br>A)