Use the information for the question(s) below.

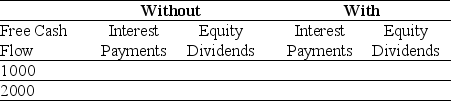

Consider two firms: firm Without has no debt, and firm With has debt of $10,000 on which it pays interest of 5% per year. Both companies have identical projects that generate free cash flows of $1000 or $2000 each year. Suppose that there are no taxes, and after paying any interest on debt, both companies use all remaining cash free cash flows to pay dividends each year.

-Fill in the table below showing the payments debt and equity holders of each firm will receive given each of the two possible levels of free cash flows:

Definitions:

Growing Annuity

A series of periodic payments that grow at a constant rate per period, often used to calculate the present value of future payments that increase over time.

Present Value

The immediate valuation of a prospective sum of money or sequences of cash payments, utilizing a certain return rate.

Rate of Return

A calculation that determines the percentage gain or loss on an investment relative to the investment's cost.

Years

Units of time measuring the duration of 365 days (or 366 days in a leap year), commonly used to quantify time.

Q4: Which stock has the highest systematic risk?<br>A)

Q22: Assume that investors hold Google stock in

Q25: The expected return on security with a

Q27: The amount of additional cash that d'Anconia

Q40: The following equation: X = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1624/.jpg"

Q41: If Rockwood finances their expansion by issuing

Q65: In an agency problem known as debt

Q65: Which of the following statements is FALSE?<br>A)

Q80: Which of the following statements is FALSE?<br>A)

Q92: Consider the following equation: P<sub>cum</sub> - P<sub>ex