Use the information for the question(s)below.

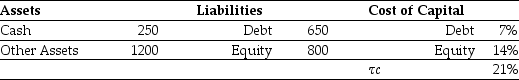

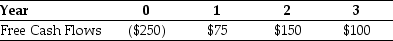

Iota Industries Market Value Balance Sheet ($ Millions)and Cost of Capital  Iota Industries New Project Free Cash Flows (Millions)

Iota Industries New Project Free Cash Flows (Millions)  Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

Assume that this new project is of average risk for Iota and that the firm wants to hold constant its debt to equity ratio.

-Calculate the NPV for Iota's new project.

Definitions:

Sales Proportional

A method or metric that relates a company's sales to another factor, measured in a ratio or percentage form to assess efficiency or performance.

Debt And Equity

Refers to the two primary ways of financing a company's operations and growth, through borrowing (debt) or selling ownership interests (equity).

Sustainable Growth Rate

The maximum rate at which a company can grow its sales, earnings and dividends without needing to increase equity or borrowings.

Debt-Equity Ratio

The measure of a company's financial leverage, calculated by dividing its total liabilities by stockholders' equity.

Q11: Biotic potential depends on all of the

Q16: If the risk-free rate of interest is

Q37: With the proper changes it is believed

Q39: Two separate firms are considering investing in

Q44: The unlevered beta for Nike is closest

Q55: Consider the following equation: β<sub>U</sub> = <img

Q57: What is the expected payoff to equity

Q76: When wet ocean winds blow onshore for

Q84: A number of populations of different species

Q93: If in the event of distress,the present