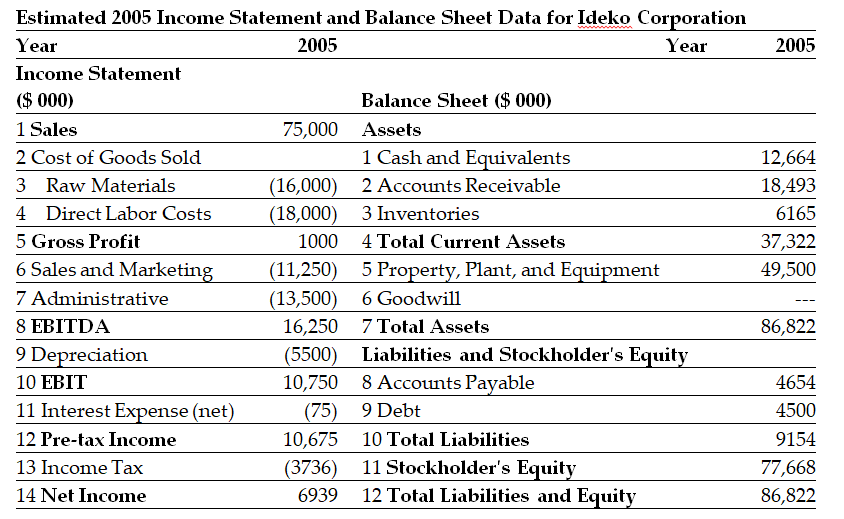

Use the tables for the question(s) below.

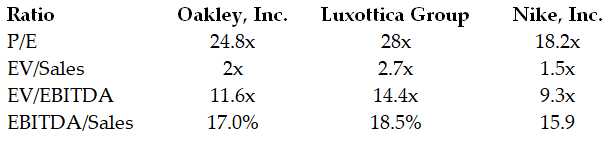

The following are financial ratios for three comparable companies:

-Based upon the average EV/Sales ratio of the comparable firms,if Ideko holds $6.5 million of cash in excess of its working capital needs,then Ideko's target market value of equity is closest to:

Definitions:

Positive Relationships

Interactions between individuals that are characterized by mutual respect, trust, and affection, enhancing well-being.

Sociometric Popularity

A measure of how well an individual is liked within social networks, often determined through peer nomination.

Negative Nominations

A term not typically found in general knowledge domains, lacking a universally recognized definition.

Rejected

Refused acceptance or admission.

Q17: Suppose that Rearden Metal currently has no

Q33: Describe the classical conditioning experiment of Ivan

Q39: Assume that investors hold Google stock in

Q48: The ocean<br>A) lacks life below the first

Q51: The date on which the board authorizes

Q59: The unlevered cost of capital for "Moe"

Q66: The theory that plants cannot grow on

Q74: Assume that investors in Google pay a

Q77: After the recapitalization,the total value of KD

Q107: What is the expected payoff to debt