Use the following information to answer the question(s) below.

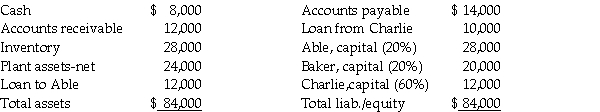

On June 30,2011,the Able,Baker,and Charlie partnership had the following fiscal year-end balance sheet:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2011,and began the liquidation process.During July the following events occurred:

The percentages shown are the residual profit and loss sharing ratios.The partners dissolved the partnership on July 1,2011,and began the liquidation process.During July the following events occurred:

* Receivables of $6,000 were collected.

* All inventory was sold for $8,000.

* All available cash was distributed on July 31,except for

$4,000 that was set aside for contingent expenses.

-The cash available for distribution to the partners on July 31,2011 is

Definitions:

Straight-Line Depreciation

An approach that spreads the expense of a physical asset across its productive lifespan in consistent yearly increments.

Capital Lease

A lease classified as a purchase by the lessee for accounting purposes, as it transfers substantially all risks and benefits of ownership.

Present Value

The value today of a sum of money to be received in the future, or a series of future payments, based on a chosen rate of return.

Minimum Lease Payments

The lowest amount that a lessee is expected to pay over the lease term, as specified in a lease agreement.

Q16: Which of the following is a reason

Q17: Plate Corporation,a US company,acquired ownership of Saucer

Q18: Plateau Incorporated bought 60% of the common

Q33: Which one of the following statements is

Q36: Assume the functional currency of a foreign

Q37: Under parent company theory,noncontrolling interest is classified

Q38: Proceeds from bonds issued for the construction

Q75: Which of the following is most volatile?<br>A)

Q133: Treating benzoic acid with both nitric acid

Q153: Fill in the missing reactants and products