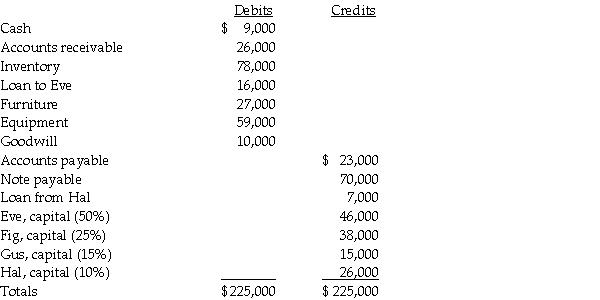

Eve,Fig,Gus,and Hal are partners who share profits and losses 50%,25%,15%,and 10%,respectively.The partnership will be liquidated gradually over several months beginning January 1,2011.The partnership trial balance at December 31,2010 is as follows:

Required:

Required:

Prepare a cash distribution plan for January 1,2011,showing how cash installments will be distributed among the partners as it becomes available.Prepare vulnerability rankings for the partners and a schedule of assumed loss absorption.

Definitions:

Employee Morale

The general perspective, mood, contentment, and assurance experienced by staff in the workplace.

Service Organizations

Businesses that primarily offer intangible products, such as work or expertise, rather than physical goods.

Government Organizations

Entities established by a government to carry out specific functions or services for the public.

Measuring Productivity

The process of determining the efficiency and effectiveness of production or performance, often quantified as output per unit of input.

Q9: Jersey Company acquired 90% of York Company

Q17: Consider the reactions<br>CH<sub>3</sub>CH<sub>2</sub>CH<sub>3</sub> + Br<sub>2</sub>/light

Q18: Voluntary health and welfare organizations classify fund-raising

Q21: On January 1,2011,Adam Corporation purchased a 90%

Q22: When a city enters into a capital

Q24: The material sale of inventory items by

Q30: On December 31,2011,Dixie Corporation has the following

Q39: On November 1,2010,Ironside Company (a U.S.manufacturer)sold an

Q39: Park Incorporated purchased a 70% interest in

Q135: For the compounds below, which statement is