Use the following information to answer the question(s) below.

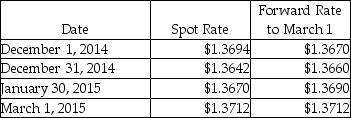

On December 1, 2014, Thomas Company, a U.S. corporation, purchases inventory from a vendor in Italy for 400,000 euros. Payment is due in 90 days. To hedge the transaction, Thomas signs a forward contract to buy 400,000 euros in 90 days at $1.3670. Thomas uses a discount rate of 6% (present value factor for 30 days = .9950; 60 days = .9901; 90 days = .9851) . Assume the forward contract will be settled net and this is a cash flow hedge. Currency exchange rates are shown below:

-What is the fair value of the forward contract at January 30?

Definitions:

Cognitive Development

The process through which individuals acquire and understand knowledge, develop problem-solving skills, and reason over time.

Diverse Beliefs

The presence and acceptance of a wide range of cultural, religious, and ideological perspectives within a society or group.

Personal Commitments

The pledges or promises individuals make to themselves or others, often guiding their personal, professional, or social actions and decisions.

Intellectual Authority

The credibility and recognition given to individuals or entities based on their expertise, knowledge, and contributions to a particular field or subject area.

Q1: The partners of the Minion,Nocti and Overly

Q13: Suzanne Quincy passed away on October 25,2011.Suzanne

Q13: On January 1,2010,Platt Corporation purchased a 30%

Q19: What basis of accounting is used to

Q20: On July 1,2010,Parslow Corporation acquired a 75%

Q24: Which of the following assets and/or liabilities

Q27: Using the original information,the balances for the

Q31: For 2011,consolidated net income will be what

Q40: Which of the following is not an

Q186: Which of the following is the most