Use the following information to answer the question(s) below.

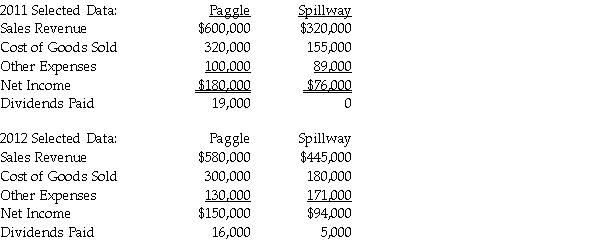

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value.At the time of purchase,the book value and fair value of Spillway's net assets were equal.The two companies report the following information for 2011 and 2012.

During 2011,one company sold inventory to the other company for $50,000 which cost the transferor $40,000.As of the end of 2011,30% of the inventory was unsold.In 2012,the remaining inventory was resold outside the consolidated entity.

-For 2011,consolidated net income will be what amount if the intercompany sale was downstream?

Definitions:

Net Present Value

Net Present Value is a method used in capital budgeting to assess the profitability of an investment, measuring the difference between the present value of cash inflows and outflows.

Cheques

Documents that are written, dated, and bear a signature, instructing a bank to pay a designated amount of money to the holder.

Daily Interest Rate

The rate at which interest accrues on a loan or investment, calculated on a daily basis.

Treasury Bills

Short-term government securities issued at a discount from par value and maturing at face value, with maturities ranging from a few days to 52 weeks.

Q2: The amount of income for the current

Q11: According to FASB Statement No.141,liabilities assumed in

Q14: On January 1,2011,Parry Incorporated paid $72,000 cash

Q23: A summary balance sheet for the Sissy,Jody,and

Q24: No return and statute limitations

Q32: The Catt,Dogg,and Eustus partnership was dissolved by

Q74: The "petitioner" refers to the party against

Q82: A U.S.District Court is the lowest trial

Q91: Butch and Minerva are divorced in December

Q176: In 2015,Ed is 66 and single.If he