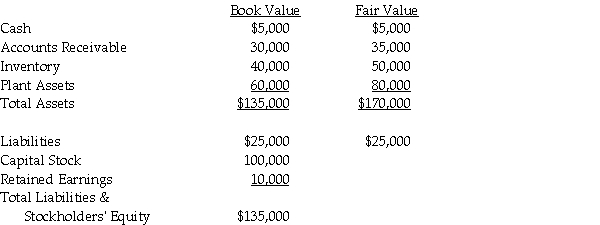

On January 1,2011,Jeff Company acquired a 90% interest in Marian Company for $198,000 cash.On January 1,2011,Marian Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers on January 1,2011.

2.Assume both companies use the parent company theory.Prepare the elimination entry(ies)on consolidating work papers on January 1,2011.

Definitions:

Fixed Manufacturing Overhead

The sum of all the production costs that are not directly linked to the volume of production, such as salaries of managers and depreciation of equipment.

Absorption Costing

A method of costing that includes all manufacturing costs—both fixed and variable—in the cost of a product.

Break-Even

The financial point at which revenues exactly cover all costs, both fixed and variable, representing no profit or loss situation with different wording.

Sales Dollars

The total monetary value of sales within a specific time period.

Q3: Parker Corporation owns an 80% interest in

Q5: Which of the following are entitled to

Q7: A summary balance sheet for the partnership

Q9: Assume the parent company theory is used.On

Q9: Parkview Holdings owns 70% of Skyline Corporation.On

Q13: Which of the following is not a

Q19: On January 1,2012,Planet Corporation,a U.S.company,acquired 100% of

Q34: How much cash must Oran invest to

Q35: A forward contract used as a cash

Q37: Johnson Corporation (a U.S.company)began operations on December