Use the following information to answer the question(s) below.

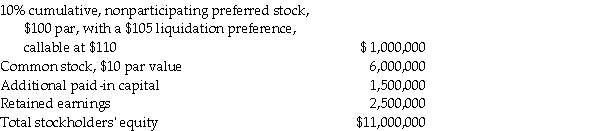

On January 1,2011,Pardy Corporation acquired a 70% interest in the common stock of Salter Corporation for $7,000,000 when Salter's stockholders' equity was as follows:

There were no preferred dividends in arrears on January 1,2011.There are no book value/fair value differentials.

There were no preferred dividends in arrears on January 1,2011.There are no book value/fair value differentials.

-Assume Salter's net income for 2011 is $220,000.No dividends are declared or paid in 2011.What is the change in Pardy's Investment in Salter for the year ending December 31,2011?

Definitions:

Corporate Bonds

Debt securities issued by corporations to finance their operations, projects, or expansion, which pay interest to investors until maturity, at which point the principal amount is repaid.

Commercial Paper

An unsecured, short-term debt instrument issued by corporations, typically used for the financing of payroll, accounts payable and inventories, and meeting other short-term liabilities.

Trade Credit

A type of commercial financing where a customer is allowed to purchase goods or services and pay the supplier at a later scheduled date.

Operating Plan

A detailed document outlining the day-to-day operations required to run a business, including production, staffing, and inventory management processes.

Q2: Static City started a department to provide

Q3: Palk Corporation has a foreign subsidiary located

Q4: 1.Urban City issued $6 million of general

Q9: Willborough County had the following transactions in

Q14: Assume Paris's inventory account had a book

Q24: Firms must conduct impairment tests more frequently

Q27: Pool Industries paid $540,000 to purchase 75%

Q27: Pretax operating incomes of Pang Corporation and

Q32: Leotronix Corporation estimates its income by calendar

Q38: A parent company regularly sells merchandise to