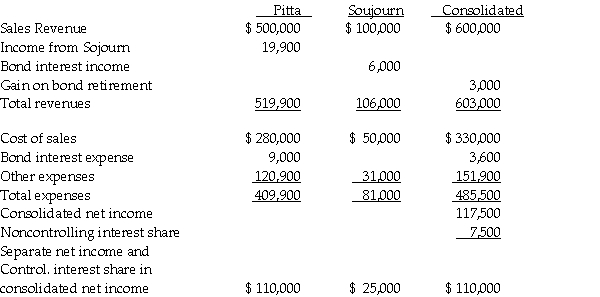

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31,2011 are summarized as follows:

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2016.On January 2,2011,a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000,9% bond issue that was issued at par value and matures on January 1,2016.On January 2,2011,a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2011?

3.What portion of the bonds payable is held by nonaffiliates at December 31,2011?

4.Is Sojourn a wholly-owned subsidiary? If not,what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Definitions:

Request An Interview

The act of formally asking for a meeting, typically for the purpose of discussing employment opportunities or journalistic inquiries.

Acquaintance

A person whom one knows but who is not a close friend.

Workforce

The collective group of individuals engaged in or available for work, either in a specific region or in the broader economy.

Increased Slightly

Indicates a minor or modest rise in quantity, degree, or level of a particular measure or condition.

Q13: What goodwill will be recorded?<br>A)$ 80,000<br>B)$240,000<br>C)$320,000<br>D)$400,000

Q13: When performing a consolidation,if the balance sheet

Q28: A summary balance sheet for the Akerly,Baskin,and

Q31: Which of the following sources has the

Q35: Carson County had the following transactions for

Q36: On July 1,2011,when Salaby Company's total stockholders'

Q39: The 2011 consolidated income statement showed cost

Q64: Logan dies with an estate worth $20

Q83: A taxpayer should always minimize his or

Q100: Taxes levied by all states include:<br>A)Tobacco excise