Use the following information to answer the question(s) below.

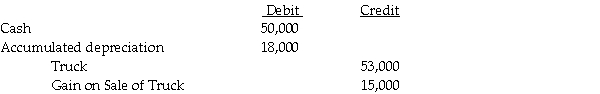

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-In preparing the consolidated financial statements for 2012,the elimination entry for depreciation expense was a

Definitions:

Myocardium

The thick, muscular tissue that makes up the middle layer of the heart wall, responsible for pumping blood through the cardiovascular system.

Heart Layer

The anatomical layers of the heart, typically referring to the endocardium, myocardium, and epicardium that make up the heart's structure.

Muscle

Tissue in the body composed of fibers capable of contracting to produce movement or maintain the position of parts of the body.

Visceral Pericardium

The innermost layer of the pericardium that lies directly on top of the heart; also known as the epicardium.

Q1: For internal decision-making purposes,Falcon Corporation identifies its

Q13: Slickton Corporation,a U.S.holding company,enters into a forward

Q23: At the time of a business acquisition,<br>A)identifiable

Q30: On January 1,2011,Jeff Company acquired a 90%

Q31: When a subsidiary has preferred stock that

Q32: On November 1,2011,Ross Corporation,a calendar-year U.S.corporation,invested in

Q40: Shebing Corporation had $80,000 of $10 par

Q44: The ad valorem tax on personal use

Q47: On occasion,Congress has to enact legislation that

Q191: Which,if any,of the following provisions cannot be