Use the following information to answer the question(s) below.

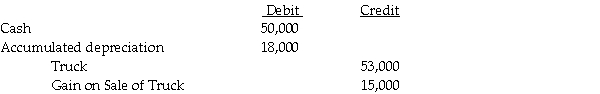

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-Controlling interest share in consolidated net income for 2012 was

Definitions:

Aboriginal Population

People who can trace their origins to First Nations, Inuit, or Métis in Canada.

Blended-Mode

An educational approach combining online digital media with traditional classroom methods.

Curriculum Delivery

The method or strategy used by educators to impart knowledge and skills to students.

Baccalaureate Degree

A postsecondary degree awarded after a course of study lasting three to seven years (or more), depending on the area of study.

Q13: Bond Interest Receivable for 2011 of Pfadt's

Q15: Paulee Corporation paid $24,800 for an 80%

Q15: Samantha's Sporting Goods had net assets consisting

Q17: On January 1,2011,Gregory Company acquired a 90%

Q21: In preparing the consolidated financial statements for

Q27: Partnerships<br>A)are required to prepare annual reports.<br>B)are required

Q30: If an affiliate purchases bonds in the

Q34: Under the entity theory,a consolidated balance sheet

Q82: Revenue Agent's Report (RAR)

Q118: The objective of pay-as-you-go (paygo) is to