Use the following information to answer the question(s) below.

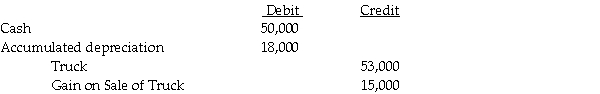

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-Parrot Company owns all the outstanding voting stock of Southern Manufacturing.On January 1,2012,Parrot sold machinery to Southern at its book value of $24,000.Parrot had the machinery three years before selling it and used an eight-year straight-line depreciation method,with zero salvage value.Southern will use the straight-line depreciation method,and assumes the machine has five years remaining and no salvage value.In the 2012 consolidating working papers,the depreciation expense

Definitions:

Industrialized Countries

Nations with significant levels of industrial activity, characterized by a high GDP and a well-developed infrastructure.

Capricious Universe

A concept suggesting the universe operates in a manner that is unpredictable and subject to sudden and unaccountable changes.

Productive Efforts

Refers to activities or endeavors that lead to the creation of goods, services, or value, contributing to economic productivity.

Q2: On January 2,2011,Pilates Inc.paid $900,000 for all

Q3: Assuming a present value factor of 1

Q4: CommTex Corporation is liquidating under Chapter 7

Q6: When preparing consolidated financial statements,which of the

Q6: Illiana Corporation has several accounting issues with

Q15: The following information was collected together for

Q24: When the bankruptcy court grants an order

Q36: On July 1,2011,when Salaby Company's total stockholders'

Q86: Virtually all state income tax returns contain

Q123: Two months after the burglary of his