Use the following information to answer the question(s) below.

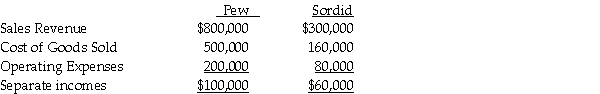

Pew Corporation acquired 80% ownership of Sordid Incorporated,at a time when Pew's investment cost was equal to 80% of Sordid's book value.At the time of acquisition,the book values and fair values of Sordid's assets and liabilities were equal.Pew uses the equity method.During 2011,Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%.Half of these goods remained unsold in Sordid's inventory at the end of the year.Income statement information for Pew and Sordid for 2011 were as follows:

-On January 1,2011,Plastam Industries acquired an 80% interest in Sparta Company to assure a steady supply of Sparta's inventory that Plastam uses in its own manufacturing businesses.Sparta sold 100% of its output to Plastam during 2011 and 2012 at a markup of 125% of Sparta's cost.Plastam had $12,000 of these items remaining in its inventory at December 31,2012.If Plastam neglected to eliminate unrealized profits from all intercompany sales from Sparta,the inventory on the consolidated balance sheet at December 31,2012 was

Definitions:

Cooperative

Pertaining to a group, business, or organization that is owned and run jointly by its members, who share the benefits and responsibilities.

Depressant Drugs

Substances that reduce the activity of the central nervous system and can lead to relaxation, reduced anxiety, or sleepiness.

Psychological Dependence

A condition characterized by a perceived need to continue using a substance due to emotional or psychological reliance, despite potential harm.

Medications

substances used in the treatment, diagnosis, or prevention of diseases and for relieving pain or affecting the structure of any part of the body.

Q6: A summary balance sheet for the Uma,Van,and

Q8: On January 2,2010,Slurg Corporation paid $600,000 to

Q19: Which one of the following items,originally recorded

Q29: Plock Corporation,the 75% owner of Seraphim Company,reported

Q29: Controlling interest share of consolidated net income

Q38: The additional standard deduction for age and

Q80: Katrina,age 16,is claimed as a dependent by

Q113: In preparing a tax return,all questions on

Q114: The tax law allows an income tax

Q117: For omissions from gross income in excess