PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1,2010,for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

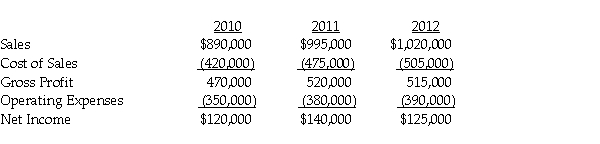

PreBuild's separate income (excluding investment income from Shoding)was $870,000,$830,000 and $960,000 in 2010,2011 and 2012,respectively.PreBuild sold inventory to Shoding during 2010 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year.The remaining 50% was sold in 2011.At the end of 2011,PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000.There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2012.PreBuild uses the equity method in its separate books.Select financial information for Shoding follows:

Required:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2010,2011,and 2012.

Definitions:

Closed Groups

Refer to a fixed membership group where no new members can join once the group has started, often used in therapeutic and workshop settings.

Bonding

The process of forming a close relationship or emotional connection with someone.

Paraphrasing

Paraphrasing involves rewording another's ideas or statements in one's own words without changing the original meaning.

Participation

The action of taking part in something or becoming involved in an activity or event.

Q3: If Bird uses the "actual-sale-date" sales assumption,its

Q4: The unamortized excess account is<br>A)a contra-equity account.<br>B)used

Q10: International accounting standards differ from U.S.Generally Accepted

Q22: Jeale Corporation is preparing its interim financial

Q24: Which of the following assets and/or liabilities

Q25: Temporary Regulations are only published in the

Q25: A U.S.importer that purchased merchandise from a

Q33: The Code section citation is incorrect: §

Q36: A tax cut enacted by Congress that

Q167: In 2015,José,a widower,sells land (fair market value