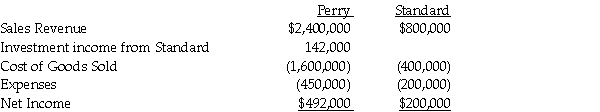

Perry Instruments International purchased 75% of the outstanding common stock of Standard Systems in 1997 when the book values and fair values of Standard's assets and liabilities were equal.The cost of Perry's investment was equal to 75% of the book value of Standard's net assets.Separate company income statements for Perry and Standard for the year ended December 31,2011 are summarized as follows:

During 2011,the companies began to manage their inventory differently,and worked together to keep their inventories low at each location.In doing so,they agreed to sell inventory to each other as needed at a markup of 10% of cost.Perry sold merchandise that cost $100,000 to Standard for $110,000,and Standard sold inventory that cost $80,000 to Perry for $88,000.Half of this merchandise remained in each company's inventory at December 31,2011.

During 2011,the companies began to manage their inventory differently,and worked together to keep their inventories low at each location.In doing so,they agreed to sell inventory to each other as needed at a markup of 10% of cost.Perry sold merchandise that cost $100,000 to Standard for $110,000,and Standard sold inventory that cost $80,000 to Perry for $88,000.Half of this merchandise remained in each company's inventory at December 31,2011.

Required:

Prepare a consolidated income statement for Perry Corporation and Subsidiary for 2011.

Definitions:

Electricity

A form of energy resulting from the existence of charged particles, used for power and a variety of applications in the modern world.

Medical Services

Healthcare and treatment provided by trained medical professionals to diagnose, treat, and prevent illness or injury.

Brand Loyalty

The tendency of consumers to continuously purchase products from the same brand due to satisfaction, preference, or perceived superiority.

Elastic

A description of a situation where the demand or supply for a good or service significantly changes in response to a change in price.

Q4: Petrol Company acquired an 90% interest in

Q5: Saveed Corporation purchased the net assets of

Q7: On January 1,2012 Saffron Co.recorded a $40,000

Q8: Saito Corporation's stockholders' equity on December 31,2010

Q16: A subsidiary can be excluded from consolidation

Q23: Prey Corporation created a wholly owned subsidiary,Sage

Q57: Tax bills are handled by which committee

Q118: The objective of pay-as-you-go (paygo) is to

Q128: Mona inherits her mother's personal residence,which she

Q167: In 2015,José,a widower,sells land (fair market value