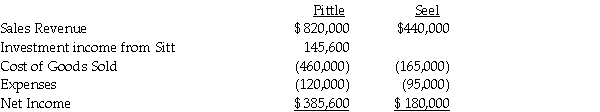

Pittle Corporation acquired a 80% interest in Seel Corporation at a cost equal to 80% of the book value of Seel's net assets several years ago.At the time of purchase,the fair value and book value of Seel's assets and liabilities were equal.Pittle purchases its entire inventory from Seel at 150% of Seel's cost.During 2011,Seel sold $490,000 of merchandise to Pittle.Pittle's beginning and ending inventories for 2011 were $72,000 and $66,000,respectively.Income statement information for both companies for 2011 is as follows:

Required:

Required:

Prepare a consolidated income statement for Pittle Corporation and Subsidiary for 2011.

Definitions:

Allocation of Resources

The process of allocating resources among competing uses or projects in order to achieve desired outcomes.

Poverty Rate

The percentage of the population whose family income falls below an absolute level called the poverty line.

Average Income

The total income received by a group divided by the number of people in that group.

Poverty Rate

The percentage of the population whose income falls below a certain threshold, defining them as living in poverty.

Q11: According to FASB Statement No.141,liabilities assumed in

Q13: On January 1,2011,Brody Company acquired an 80%

Q18: Pigeon Corporation acquired an 80% interest in

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q23: Bailey's noncontrolling interest share for 2011 is<br>A)$7,609.<br>B)$8,044.<br>C)$15,652.<br>D)$23,696.

Q23: A parent company uses the equity method

Q24: The basic and additional standard deductions both

Q25: Que,Rae,and Sye are in the process of

Q29: Pental Corporation bought 90% of Sedacor Company's

Q33: Under the income tax formula,a taxpayer must