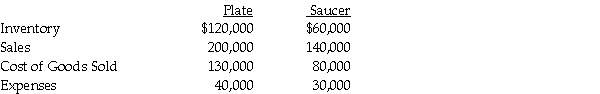

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2011.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2010,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2010,but was sold in 2011.In 2011,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2011.

In 2010,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2010,but was sold in 2011.In 2011,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2011.

Required: Calculate following balances at December 31,2011.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Definitions:

Wide Base Singles

Single, broader tires designed to replace traditional dual tires on vehicles, improving efficiency and load-carrying capacity.

Drive Axles

Components of a vehicle's drivetrain that transfer power from the transmission to the wheels, enabling motion.

Paccar

A global technology company known for designing, manufacturing, and providing customer support for high-quality light, medium, and heavy-duty trucks.

Truck Brand

A specific make or marque of trucks, distinguished by a unique name, symbol, or feature, associated with specific manufacturers.

Q1: On January 1,2011,Jeff Company acquired a 90%

Q7: Pinkerton Inc.owns 10% of Sable Company.In the

Q9: What is the purpose of interim reporting?<br>A)Provide

Q13: What goodwill will be recorded?<br>A)$ 80,000<br>B)$240,000<br>C)$320,000<br>D)$400,000

Q24: On January 1,2011,Penny Company acquired a 90%

Q33: Which one of the following statements is

Q47: On occasion,Congress has to enact legislation that

Q62: Rules of tax law do not include

Q77: What is the difference between an inheritance

Q164: Darren,age 20 and not disabled,earns $4,000 during