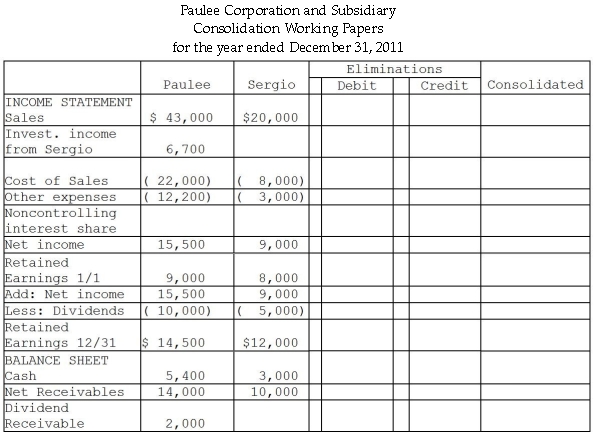

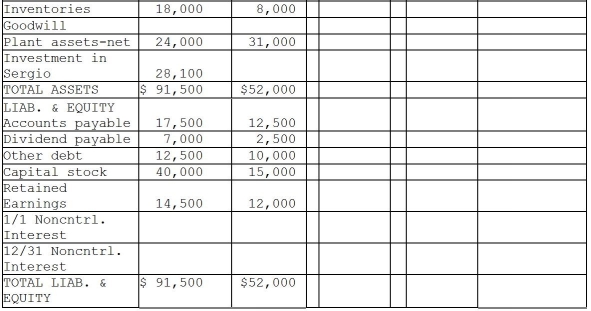

Paulee Corporation paid $24,800 for an 80% interest in Sergio Corporation on January 1,2010,at which time Sergio's stockholders' equity consisted of $15,000 of Common Stock and $6,000 of Retained Earnings.The fair values of Sergio Corporation's assets and liabilities were identical to recorded book values when Paulee acquired its 80% interest.

Sergio Corporation reported net income of $4,000 and paid dividends of $2,000 during 2010.

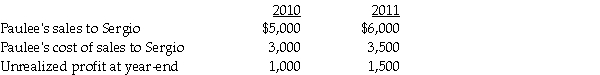

Paulee Corporation sold inventory items to Sergio during 2010 and 2011 as follows:

At December 31,2011,the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.

At December 31,2011,the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.

Required:

Financial statements of Paulee and Sergio appear in the first two columns of the partially completed working papers.Complete the consolidation working papers for Paulee Corporation and Subsidiary for the year ended December 31,2011.

Definitions:

Brain Stem

The brain stem is the lower extension of the brain, connected to the spinal cord, responsible for controlling essential life-sustaining functions like breathing and heart rate.

Cerebral Cortex

The outer layer of the cerebrum in the brain, involved in high-level functions such as sensory perception, reasoning, and voluntary muscle activity.

Sympathetic Nervous System

Part of the autonomic nervous system that activates what is often termed the fight or flight response.

Cerebellum

A portion of the brain involved in coordinating movement and balance, located beneath the cerebral hemispheres.

Q9: If a sale on account by a

Q16: When a cash flow hedge is appropriate,the

Q17: Which partner is considered the most vulnerable

Q19: Pass Corporation owns 80% of Sindy Company,purchased

Q20: For internal decision-making purposes,Dashwood Corporation's operating segments

Q26: From the standpoint of accounting theory,which of

Q37: Under the Federal income tax formula for

Q60: Tax research involves which of the following

Q99: In 2015,Hal furnishes more than half of

Q135: Late filing and statute limitations (deficiency situations)