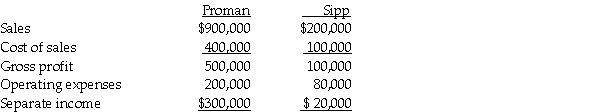

Proman Manufacturing owns a 90% interest in Sipp Company,purchased at a time when the book values of Sipp's recorded assets and liabilities were equal to fair values.During 2011,Sipp sold merchandise to Proman for $80,000 at a 20% gross profit.At December 31,2011,25% of this merchandise is still in Proman's inventory.Separate incomes for Proman and Sipp are summarized as follows:

Required: Prepare a consolidated income statement for 2011 for Proman and subsidiary.

Required: Prepare a consolidated income statement for 2011 for Proman and subsidiary.

Definitions:

Spending Variance

The difference between the actual amount of money spent and the budgeted amount expected to be spent.

Food And Supplies

Items necessary for the operation of a service, especially in the hospitality and retail industries, including edible products and necessary equipment.

Tenant-Days

A metric used in property management to calculate the total number of days tenants occupy a space within a given period.

Net Operating Income

The income generated from normal business operations after deducting operating expenses but before taxes and interest.

Q2: Pike Corporation paid $100,000 for a 10%

Q9: On January 1,2011,Pilgrim Imaging purchased 90% of

Q9: What is the purpose of interim reporting?<br>A)Provide

Q14: A U.S.parent corporation loans funds to a

Q21: An individual taxpayer uses a fiscal year

Q22: The following assets of Poole Corporation's Romanian

Q23: At the time of a business acquisition,<br>A)identifiable

Q32: Mitigation of the annual accounting period concept

Q37: Taxes levied by both states and the

Q55: Which Regulations have the force and effect