Use the following information to answer the question(s) below.

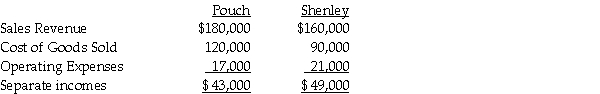

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1,2012,when the book values of Shenley's assets and liabilities were equal to their fair values.The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets.During 2012,Pouch sold merchandise that cost $70,000 to Shenley for $86,000.On December 31,2012,three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory.Separate incomes (investment income not included) of the two companies are as follows:

-What is Pouch's income from Shenley for 2012?

Definitions:

Q4: If the bonds were originally issued at

Q21: Perry Instruments International purchased 75% of the

Q21: On January 1,2011,Adam Corporation purchased a 90%

Q23: Which one of the following operating segment

Q24: On July 1,2011,Polliwog Incorporated paid cash for

Q26: Anthony Company declared and paid $20,000 of

Q27: Pool Industries paid $540,000 to purchase 75%

Q30: A U.S.firm has a Belgian subsidiary that

Q59: Determination letters usually involve finalized transactions.

Q179: The tax law allows,under certain conditions,deferral of