Use the following information to answer the question(s) below.

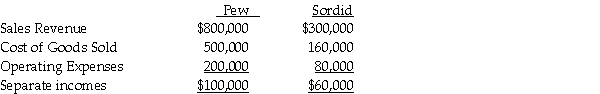

Pew Corporation acquired 80% ownership of Sordid Incorporated,at a time when Pew's investment cost was equal to 80% of Sordid's book value.At the time of acquisition,the book values and fair values of Sordid's assets and liabilities were equal.Pew uses the equity method.During 2011,Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%.Half of these goods remained unsold in Sordid's inventory at the end of the year.Income statement information for Pew and Sordid for 2011 were as follows:

-On January 1,2011,Plastam Industries acquired an 80% interest in Sparta Company to assure a steady supply of Sparta's inventory that Plastam uses in its own manufacturing businesses.Sparta sold 100% of its output to Plastam during 2011 and 2012 at a markup of 125% of Sparta's cost.Plastam had $12,000 of these items remaining in its inventory at December 31,2012.If Plastam neglected to eliminate unrealized profits from all intercompany sales from Sparta,the inventory on the consolidated balance sheet at December 31,2012 was

Definitions:

Complex Information Technology

Refers to advanced and multifaceted computer systems, software, and networks designed to handle sophisticated tasks and processes in diverse environments.

Desktop Videoconferencing Systems

Technology platforms that allow users at different locations to conduct face-to-face meetings without physically moving to a single location.

Virtual Teams

Groups of individuals who work together from various geographic locations and rely on communication technology to collaborate.

Flatter Organization

An organization with fewer hierarchical levels, promoting better communication, quicker decision-making, and often higher employee morale.

Q2: Peter Corporation owns 90% of the common

Q7: Padhy Corporation owns 80% of Abrams Corporation,Abrams

Q20: For internal decision-making purposes,Dashwood Corporation's operating segments

Q30: Technical Advice Memoranda deal with completed transactions.

Q31: Exchange gains or losses from remeasurement appear<br>A)in

Q35: A tax professional need not worry about

Q47: On occasion,Congress has to enact legislation that

Q128: Mona inherits her mother's personal residence,which she

Q134: The ratification of the Sixteenth Amendment to

Q188: Roy and Linda were divorced in 2014.The