Use the following information to answer the question(s) below..

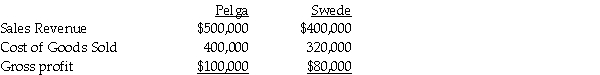

Pelga Company routinely receives goods from its 80%-owned subsidiary,Swede Corporation.In 2011,Swede sold merchandise that cost $80,000 to Pelga for $100,000.Half of this merchandise remained in Pelga's December 31,2011 inventory.This inventory was sold in 2012.During 2012,Swede sold merchandise that cost $160,000 to Pelga for $200,000.$62,500 of the 2012 merchandise inventory remained in Pelga's December 31,2012 inventory.Selected income statement information for the two affiliates for the year 2012 was as follows:

-Shalles Corporation,a 80%-owned subsidiary of Pani Corporation,sold inventory items to its parent at a $48,000 profit in 2012.Pani resold one-third of this inventory to outside entities.Shalles reported net income of $200,000 for 2012.Noncontrolling interest share of consolidated net income that will appear in the income statement for 2012 is

Definitions:

Urine Density

The concentration of substances such as salts and minerals in urine, an indicator of hydration and kidney function.

Glomerular Blood Pressure

The blood pressure within the glomerular capillaries of the kidney, essential for the filtration of blood into the urinary system.

Filtration Membrane

A barrier consisting of multiple layers through which substances are filtered, commonly used in reference to the kidney's filtration apparatus.

Capillary Endothelium

The single layer of cells lining the interior surface of blood capillaries, involved in the exchange of materials such as oxygen and carbon dioxide between blood and tissues.

Q20: What is Pouch's income from Shenley for

Q20: Gains or losses on foreign currency transactions

Q21: Sales made by mail order are not

Q30: On October 15,2011,Napole Corporation,a French company,ordered merchandise

Q34: Cass Corporation's balance sheet at December 31,2011

Q35: A 15% stock dividend by a subsidiary

Q38: The estimated taxable income for Shebill Corporation

Q60: In connection with facilitating the function of

Q66: The tax law contains various provisions that

Q113: In preparing a tax return,all questions on