PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1,2010,for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

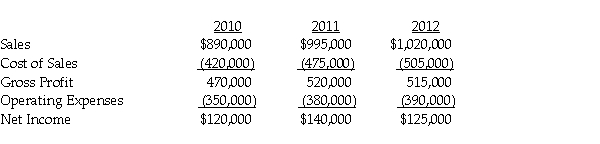

PreBuild's separate income (excluding investment income from Shoding)was $870,000,$830,000 and $960,000 in 2010,2011 and 2012,respectively.PreBuild sold inventory to Shoding during 2010 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year.The remaining 50% was sold in 2011.At the end of 2011,PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000.There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2012.PreBuild uses the equity method in its separate books.Select financial information for Shoding follows:

Required:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2010,2011,and 2012.

Definitions:

Electrolyte Imbalance

A condition where the levels of electrolytes (minerals like sodium, potassium, and calcium) in the body are either too high or too low, affecting bodily functions.

Thiazide Diuretics

A class of medications that promotes the removal of salt and water from the body, mainly used to treat high blood pressure.

Osteoporosis

A bone disease characterized by a decrease in bone mass and density, leading to an increased risk of fractures.

Steroids

A class of biologically active compounds with various medical uses, including reducing inflammation and treating autoimmune diseases.

Q13: What goodwill will be recorded?<br>A)$ 80,000<br>B)$240,000<br>C)$320,000<br>D)$400,000

Q15: The income from an equity method investee

Q21: Consider a sale of stock by a

Q21: Crabby Industries,a U.S.corporation,purchased inventory from a company

Q26: Pommu Corporation paid $78,000 for a 60%

Q29: Sandy Corporation's stockholders' equity on December 31,2010

Q58: Under the usual state inheritance tax,two heirs,a

Q131: What is a severance tax? How productive

Q151: Married taxpayers who file a joint return

Q180: A CPA firm in California sends many