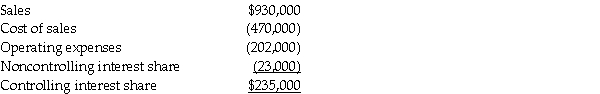

Pastern Industries has an 80% ownership stake in Sascon Incorporated.At the time of purchase,the book value of Sascon's assets and liabilities were equal to the fair value.The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets.At the end of 2011,they issued the following consolidated income statement:

Shortly after the statements were issued,Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact,Pastern had sold inventory that cost $80,000 to Sascon for $90,000,and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31,2011.

Shortly after the statements were issued,Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact,Pastern had sold inventory that cost $80,000 to Sascon for $90,000,and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31,2011.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2011.

Definitions:

Border Patrol

Government agents tasked with monitoring and securing a country’s borders to prevent illegal immigration and trafficking.

Civil Commitment Laws

Legal statutes that allow for the involuntary detention and treatment of individuals deemed a danger to themselves or others, usually due to mental illness.

Kansas v. Hendricks

A landmark legal case in which the United States Supreme Court upheld the constitutionality of civilly committing sexual predators post their prison terms, under certain conditions.

Juvenile Superpredators

A controversial term used to describe young individuals who commit serious crimes with perceived recklessness and lack of remorse.

Q10: Assume there are routine inventory sales between

Q14: Papal Corporation acquired an 80% interest in

Q17: On January 1,2011,Gregory Company acquired a 90%

Q21: For the year ending December 31,2011,the amount

Q31: Plenny Corporation sold equipment to its 90%-owned

Q36: When the kiddie tax applies,the child need

Q39: For an operating segment to be considered

Q57: In terms of probability,which of the following

Q85: Many taxpayers who previously itemized will start

Q92: Married taxpayers who file separately cannot later