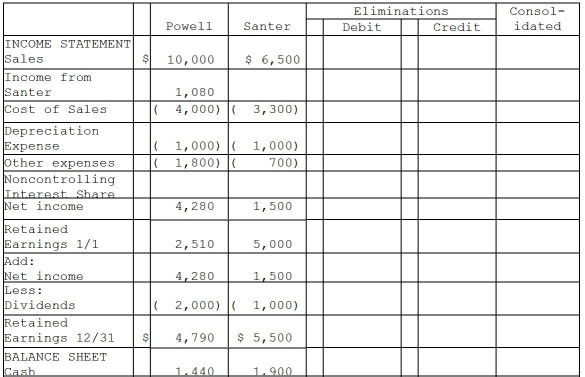

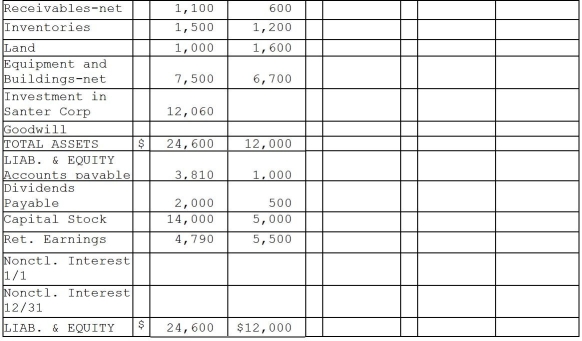

Powell Corporation acquired 90% of the voting stock of Santer Corporation on January 1,2010 for $11,700 when Santer had Capital Stock of $5,000 and Retained Earnings of $4,000.The amounts reported on the financial statements approximated fair value,with the exception of inventories,which were understated on the books by $500 and were sold in 2010,land which was undervalued by $1,000,and equipment with a remaining useful life of 5 years under the straight-line method which was undervalued by $1,500.Any remainder was assigned to goodwill.

Financial statements for Powell and Santer Corporations at the end of the fiscal year ended December 31,2011 appear in the first two columns of the partially completed consolidation working papers.Powell has accounted for its investment in Santer using the equity method of accounting.Powell Corporation owed Santer Corporation $100 on open account at the end of the year.Dividends receivable in the amount of $450 payable from Santer to Powell is included in Powell's net receivables.

Required:

Complete the consolidation working papers for Powell Corporation and Subsidiary for the year ended December 31,2011.

Definitions:

Stamp Act Congress

was a meeting held in 1765 in New York City, consisting of representatives from several of the British colonies in North America; it was the first gathering of elected representatives to devise a unified protest against new British taxation.

Colonial Resisters

Individuals in the American colonies who opposed British rule, leading to actions such as protests, boycotts, and eventually the Revolutionary War.

Unity and Cooperation

The act of coming together and working jointly towards common goals, highlighting the importance of collective effort and collaboration.

Repealing

The action of revoking or nullifying an existing law or regulation.

Q2: Austin contributes his computer equipment to the

Q7: Subsequent to an acquisition,the parent company and

Q8: In terms of income tax consequences,abandoned spouses

Q31: The filing status of a taxpayer (e.g.

Q38: A parent company regularly sells merchandise to

Q47: On occasion,Congress has to enact legislation that

Q64: What statement is not true with respect

Q69: A child who has unearned income of

Q149: A child who is married cannot be

Q159: Kim,a resident of Oregon,supports his parents who