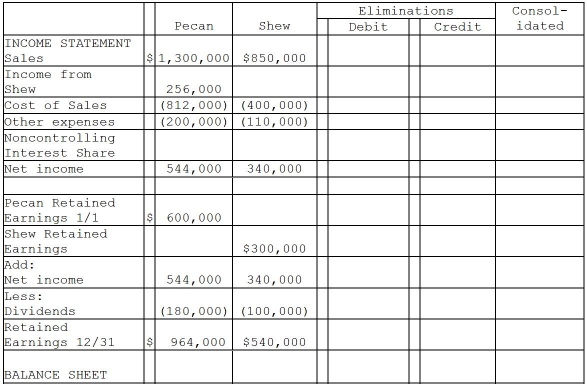

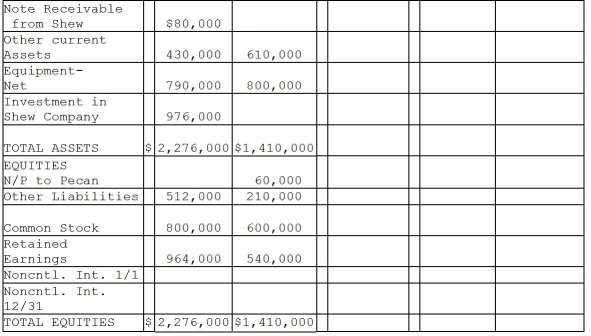

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2,2011 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2011,Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan,and on December 31,2011,Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4,2012,and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31,2011.

Definitions:

Folk Concepts

Informal, culturally specific beliefs and understandings about the world, often passed down through generations and not necessarily based on scientific evidence.

Everyday Variables

Factors or conditions that occur in daily life and can influence outcomes or behaviors in various contexts.

Emotional Intelligence

A type of intelligence defined and measured by four branches (one’s ability to perceive emotion, utilize emotions to facilitate thought, understand emotion, and manage emotion).

MBTI

Myers-Briggs Type Indicator, a personality inventory that categorizes individuals into 16 distinct personality types based on preferences in how they perceive the world and make decisions.

Q7: Frank sold his personal use automobile for

Q8: Pool Industries paid $540,000 to purchase 75%

Q11: A Federal excise tax is no longer

Q30: As it is consistent with the wherewithal

Q30: On January 1,2011,Plastam Industries acquired an 80%

Q33: Congress reacts to judicial decisions that interpret

Q35: Pomograte Corporation bought 75% of Sycamore Company's

Q39: Drawings<br>A)are advances to a partnership.<br>B)are loans to

Q97: Stealth taxes are directed at lower income

Q152: Two persons who live in the same