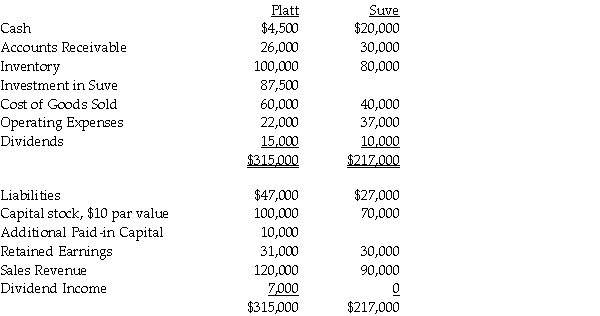

Platt Corporation paid $87,500 for a 70% interest in Suve Corporation on January 1,2011,when Suve's Capital Stock was $70,000 and its Retained Earnings $30,000.The fair values of Suve's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2011 are given below:

During 2011,Platt made only two journal entries with respect to its investment in Suve.On January 1,2011,it debited the Investment in Suve account for $87,500 and on November 1,2011,it credited Dividend Income for $7,000.

During 2011,Platt made only two journal entries with respect to its investment in Suve.On January 1,2011,it debited the Investment in Suve account for $87,500 and on November 1,2011,it credited Dividend Income for $7,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Platt and Subsidiary for the year ended December 31,2011.

2.Prepare a consolidated balance sheet for Platt and Subsidiary as of December 31,2011.

Definitions:

Bulbospongiosus

A muscle of the perineum that plays a role in sexual function and urination.

Ischiocavernosus

A muscle that helps stiffen the penis or clitoris during sexual arousal by compressing the base of the erectile tissues.

Semispinalis Thoracis

A muscle in the back that extends from the thoracic vertebrae to the base of the skull, helping in the extension and rotation of the spine.

Multifidus

A muscle located in the spine that stabilizes the vertebrae and assists with spinal movements.

Q2: The amount of income for the current

Q3: Using the original information,the elimination entries on

Q7: A calendar year taxpayer files his 2014

Q15: Required:<br>1.Prepare a schedule to allocate income to

Q15: Samantha's Sporting Goods had net assets consisting

Q20: The equation,in a set of simultaneous equations,that

Q26: Under the entity theory,a consolidated balance sheet

Q30: In the preparation of consolidated financial statements,which

Q34: Salter has a 2011 net loss of

Q164: A fixture will be subject to the