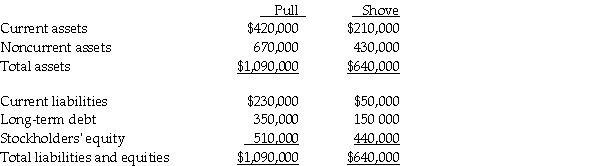

Pull Incorporated and Shove Company reported summarized balance sheets as shown below,on December 31,2011.

On January 1,2012,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2012,with each payment consisting of $30,000 principal,plus accrued interest.

On January 1,2012,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2012,with each payment consisting of $30,000 principal,plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent)and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts,on the consolidated balance sheet,immediately following the acquisition.

a.Current assets

b.Noncurrent assets

c.Current liabilities

d.Long-term debt

e.Stockholders' equity

Definitions:

Internal Equity

Perceived equity of a pay system across different jobs within an organization.

Overtime Costs

Expenses incurred by employers when employees work beyond their scheduled or standard working hours, typically compensated at a higher rate.

Open-Door Policy

A company policy that encourages employees to address their problems to higher levels of management.

Peer Review Panel

A group of professionals assessing the work of their colleagues, typically used in academia and professional settings to maintain quality standards.

Q1: In computing consolidated diluted EPS,the replacement calculation

Q10: International accounting standards differ from U.S.Generally Accepted

Q11: On January 2,2011,Power Incorporated paid $630,000 for

Q23: Prey Corporation created a wholly owned subsidiary,Sage

Q30: A subsidiary has dilutive securities outstanding that

Q32: On January 1,2011,Singh Company acquired an 80

Q34: The following data relate to Falcon Corporation's

Q36: On January 1,2010,Starling Corporation held an 80%

Q137: A safe and easy way for a

Q174: Jock tax