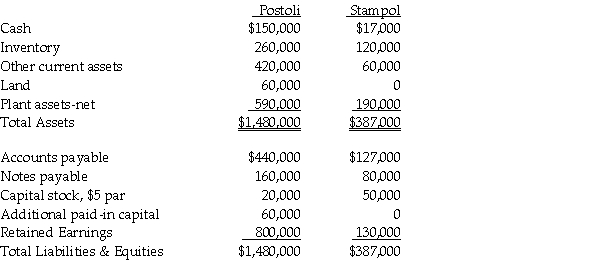

On June 30,2011,Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated.Postoli paid $40,000 in cash to the owner of Stampol,and signed a five-year note payable to the owners of Stampol in the amount of $200,000.Their closing balance sheets as of June 30,2011 are shown below.In the purchase agreement,both parties noted that Inventory was undervalued on the books by $10,000,and Pistoli would also take possession of a customer list with a fair value of $18,000.Pistoli paid all legal costs of the acquisition,which amounted to $7,000.

Required:

Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

Definitions:

Ethernet Port

An RJ-45 port that connects a device to the wired network.

RJ-45

A connector standard predominantly used for Ethernet networking, facilitating wired connections between networked devices.

Antistatic Bag

A plastic enclosure that protects electronic gear from being affected by static charges if the equipment is left exposed.

Motherboards

The main circuit board of a computer, to which all other components connect directly or indirectly.

Q2: Which of the following will be debited

Q8: In terms of income tax consequences,abandoned spouses

Q10: Resident of Canada or Mexico

Q21: In preparing the consolidated financial statements for

Q34: On September 1,2011,Nelson Corporation acquired a 90%

Q37: Johnson Corporation (a U.S.company)began operations on December

Q44: The ad valorem tax on personal use

Q106: Nonresident alien

Q110: Characteristics of the "Fair Tax" (i.e. ,national

Q172: Surviving spouse filing status begins in the