Essay

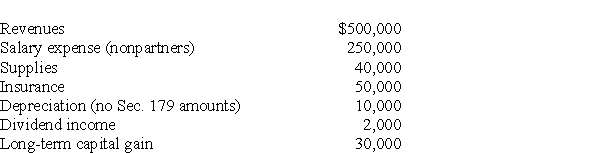

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Definitions:

Related Questions

Q6: Monetary policy is often believed to be

Q7: Grant Corporation transfers highly appreciated stock to

Q9: Blair and Cannon Corporations are the two

Q12: Assuming a cost of equity capital

Q13: Given the above data,calculate the quick

Q14: An investor expects Tom Fun Ltd

Q30: Identify which of the following statements is

Q31: The goal of supply side policies is

Q43: Certain adjustments must be made to alternative

Q71: Parent Corporation purchases a machine (a five-year