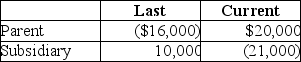

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year the group files a consolidated return. Taxable Income How much of the Subsidiary loss can be carried back to last year?

How much of the Subsidiary loss can be carried back to last year?

Definitions:

Treatment

The intervention or set of interventions designed to address a disease, condition, or disorder.

Attentive

The quality of paying close and careful attention to detail, being alert and focused on the task or situation at hand.

Conscious

Being aware of one's own existence, sensations, thoughts, and surroundings.

Traditional Analysis

A conventional method of examination or evaluation, typically based on established techniques that have been widely accepted in a particular field.

Q20: Batten and Ellis (1996)examine the performance of

Q22: Identify which of the following statements is

Q24: Assume that the S&P 200 is

Q27: Lake City Corporation owns all the stock

Q33: Identify which of the following statements is

Q34: Under Illinois Corporation's plan of liquidation,the corporation

Q50: Limited partners must consider the at-risk,basis,and passive

Q52: Exit Corporation has accumulated E&P of $24,000

Q54: Under a plan of complete liquidation,Key Corporation

Q83: The adjusted basis of property received in