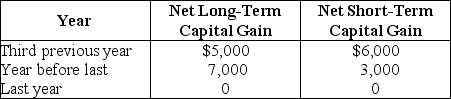

Lass Corporation reports a $25,000 net capital loss this year.The corporation reports the following net capital gains during the past three years.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss,if any,available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss,if any,available as a carryforward.

Definitions:

Government Funding

The financial resources provided by the government, derived from taxpayers, to finance various public expenditures, including infrastructure, welfare, and defense.

Media Outlet

An organization or publication that disseminates news and other information to the public, such as newspapers, television stations, radio stations, and digital platforms.

National Public Radio

A publicly funded radio network in the United States that provides news, analysis, and cultural programming.

Media Coverage

The reporting, analysis, and broadcasting of news and information by various media outlets, including newspapers, television, radio, and the internet, often influencing public perception and opinion.

Q3: Income in respect of a decedent (IRD)is

Q45: Maury Corporation has 200 shares of stock

Q57: Hope Corporation was liquidated four years ago.Teresa

Q72: Wills Corporation,which has accumulated a current E&P

Q75: You are preparing the tax return for

Q82: Parent and Subsidiary Corporations are members of

Q88: When a liquidating corporation pays off an

Q95: A stock redemption is always treated as

Q98: Which of the following transactions does not

Q104: Identify which of the following statements is