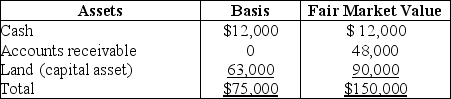

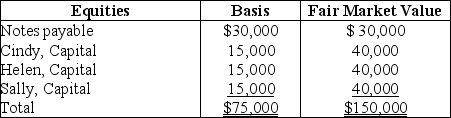

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable.Her basis for the partnership interest before any distribution is $25,000.What gain/loss should she report for tax purposes?

Cindy withdraws from the partnership under an agreement whereby she takes one-third of each of the three assets and assumes $10,000 of the notes payable.Her basis for the partnership interest before any distribution is $25,000.What gain/loss should she report for tax purposes?

Definitions:

Dual Federalism

The political concept where state governments and the federal government have clearly defined and separate areas of authority and responsibility.

National Government

The organization through which political authority is exercised at the national level, governing the entire country.

Regulation of Slavery

Historical laws and policies governing the treatment, trade, and conditions of enslaved people.

Concurrent Power

Powers that are shared by both the state and the federal government, allowing both to legislate and govern simultaneously in the same areas.

Q7: On Schedule B of Form 941,the employer

Q21: The CHS Partnership's balance sheet presented below

Q23: Treasury Department Circular 230 regulates the practice

Q52: Marc is a calendar-year taxpayer who owns

Q54: A trust is required to distribute 10%

Q59: On December 31,Kate receives a $28,000 liquidating

Q60: An employer can use a credit card

Q75: Identify which of the following statements is

Q75: All interns in the for-profit sector are

Q89: What are the advantages of a firm