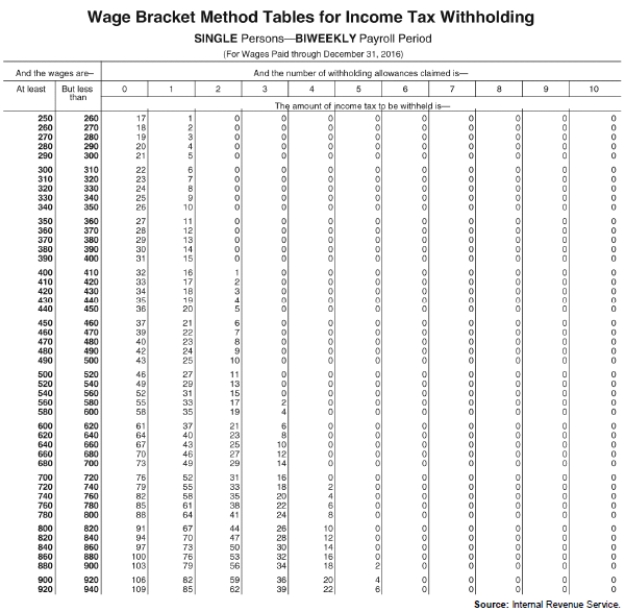

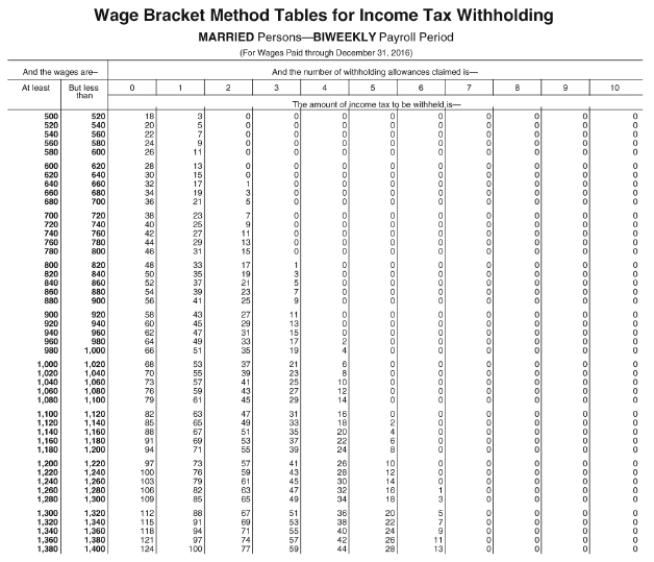

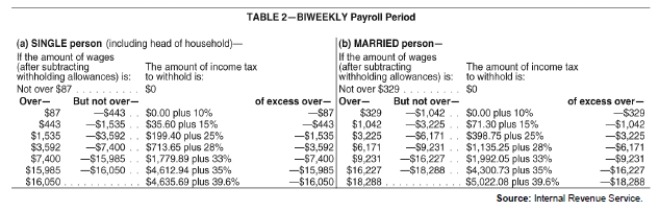

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

-Refer to Exhibit 4-1.Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $155.80):

Patrick Patrone (single,2 allowances),$925 wages

__________

Carson Leno (married,4 allowances),$1,195 wages

__________

Carli Lintz (single,0 allowances),$700 wages

__________

Gene Hartz (single,1 allowance),$2,500 wages

__________

Mollie Parmer (married,2 allowances),$3,600 wages

__________

Definitions:

Ordinary Sadness

Normal feelings of unhappiness or sorrow that are typically transient and a natural response to life's disappointments or losses.

Impaired

Having reduced function or capability in a physical or cognitive sense.

Major Depressive Disorder

A mental health condition marked by persistent feelings of sadness, hopelessness, and loss of interest, often accompanied by physical symptoms.

Debilitating

Debilitating describes a condition or illness that severely affects one's strength or ability to carry out day-to-day activities.

Q16: Explain the justification for using the percentage-of-completion

Q19: The Fair labor Standards Act has set

Q27: It is usually considered that IFRS standards

Q28: In determining whether a sale has taken

Q43: Tips received by employees are not included

Q79: Under Sec.751,unrealized receivables include potential Section 1245

Q80: A partnership cannot recognize a gain or

Q85: When a court discusses issues not raised

Q89: A tax case cannot be appealed when

Q91: Ralph's business records were lost as a