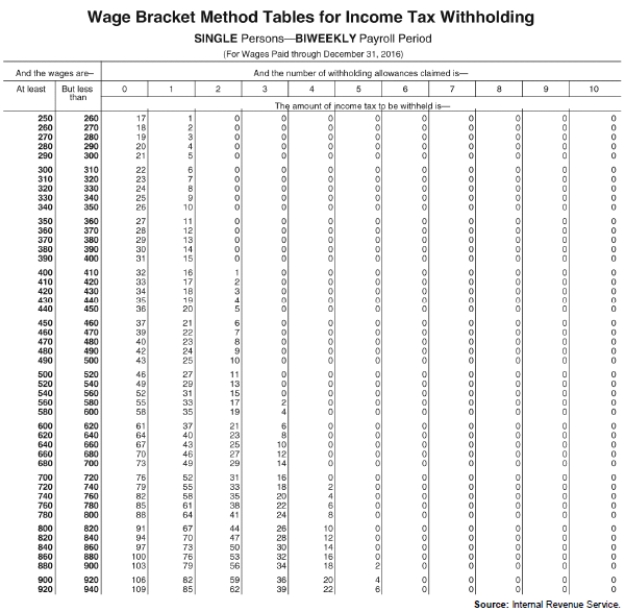

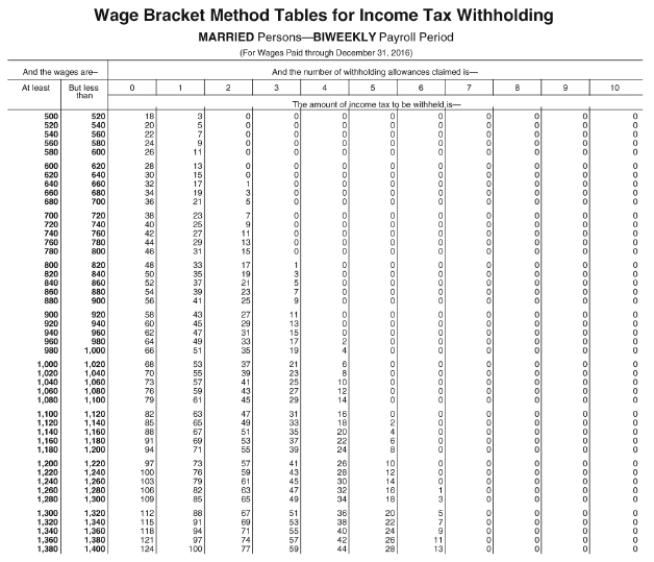

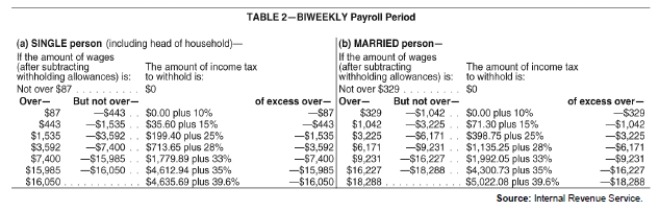

Exhibit 4-1:

Use the following tables to calculate your answers.

Source: Internal Revenue Service

Source: Internal Revenue Service

-Refer to Exhibit 4-1.Use the appropriate table to determine the amount to withhold for federal income tax from each of the following biweekly wages (biweekly withholding allowance = $155.80):

Patrick Patrone (single,2 allowances),$925 wages

__________

Carson Leno (married,4 allowances),$1,195 wages

__________

Carli Lintz (single,0 allowances),$700 wages

__________

Gene Hartz (single,1 allowance),$2,500 wages

__________

Mollie Parmer (married,2 allowances),$3,600 wages

__________

Definitions:

Warranty of Title

A guarantee provided by a seller to a buyer that the seller has the right to sell the property and that there are no undisclosed liens, claims, or encumbrances against it.

Good and Valid

A legal term indicating that a document, agreement, or transaction is legally sound and effectively in place.

Inconsistent Warranties

Warranties that offer conflicting guarantees or statements about a product, leading to confusion about coverage.

Render Invalid

To make something null and void or to deprive it of legal force.

Q5: Educational assistance payments made to workers to

Q9: The requisition for personnel form is sent

Q14: The Framework in relation to conservatism:<br>A)Explicitly states

Q24: Posting to the general ledger for payroll

Q27: A citator is used to find<br>A) the

Q31: The form of market efficiency in which

Q31: Which of the following is not required

Q39: Refer to Exhibit 4-1.Use the appropriate table

Q42: Refer to Instruction 5-1.John Gercke is an

Q53: Identify which of the following statements is