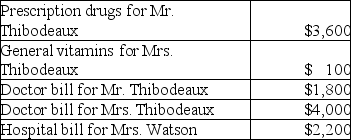

Mr.and Mrs.Thibodeaux (both age 35) ,who are filing a joint return,have adjusted gross income of $75,000.During the tax year,they paid the following medical expenses for themselves and for Mrs.Thibodeaux's mother,Mrs.Watson (age 63) .Mrs.Watson provided over one-half of her own support.

Mr.and Mrs.Thibodeaux received no reimbursement for the above expenditures.What is the amount of their deductible itemized medical expenses?

Definitions:

Normal Profits

The minimum level of profit needed for a company to remain competitive in the market, also seen as the opportunity cost of capital.

Purely Competitive Firm

A business operating in a market where there are many buyers and sellers, with none being able to influence prices significantly by their individual actions.

Costs

The value of resources consumed in the production of goods and services, including both fixed and variable expenses.

Differentiated Product

A product that is distinct in some way from others in the same category, allowing the seller to compete on factors other than price.

Q1: Five different capital gain tax rates could

Q29: An ordinary annuity assumes _-of-period payments,while an

Q30: Chad and Jaqueline are married and have

Q57: In preparing an annual budget,allow for unexpected

Q66: Which economic trend below is not likely

Q72: Jamie sells investment real estate for $80,000,resulting

Q85: Ellie,a CPA,incurred the following deductible education expenses

Q97: Chen had the following capital asset transactions

Q104: Ronna is a professional golfer.In order to

Q126: Expenses related to a hobby are deductible