Essay

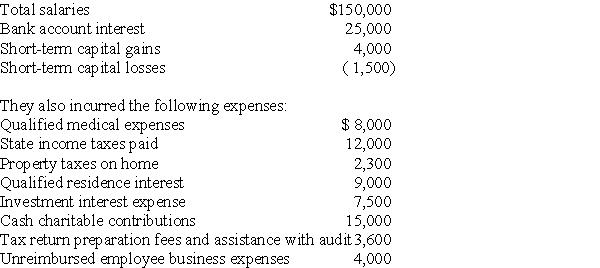

During 2017,Richard and Denisa,who are married and have two dependent children,have the following income and losses:

Compute Richard and Denisa's taxable income for the year.(Show all calculations in good form.)

Definitions:

Related Questions

Q3: Lindsay Corporation made the following payments to

Q21: A review of the 2017 tax file

Q30: All of the following deductible expenses are

Q52: Which of the following is not a

Q54: Gayle,a doctor with significant investments in the

Q54: Ming,who has been employed by the Frostine

Q85: Juan has a casualty loss of $32,500

Q93: Because of the locked-in effect,high capital gains

Q102: All recognized gains and losses must eventually

Q130: Taxpayers who own mutual funds recognize their