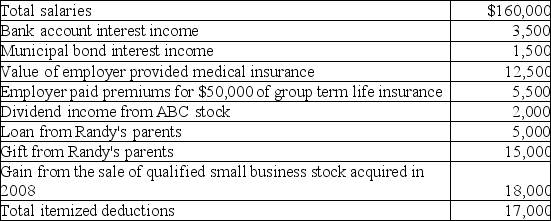

Randy and Sharon are married and have two dependent children.Their 2017 tax and other related information is as follows:

Compute Randy and Sharon's taxable income.(Show all calculations in good form.)

Definitions:

Storming

A stage in team development marked by conflict and competition as team members work to establish norms and structures.

Team Cohesiveness

Reflects the bond that encourages members of a group to work together effectively, characterized by unity, trust, and a commitment to collective success.

Increased Interaction

a rise in the level of communication or engagement between entities or individuals.

Office Design

The arrangement and styling of the workplace, including spatial layout and choice of furnishings, intended to optimize productivity and wellbeing.

Q32: Leigh inherited $65,000 of City of New

Q53: Eliza Smith's father,Victor,lives with Eliza who is

Q61: Each year a taxpayer must include in

Q69: CT Computer Corporation,a cash-basis taxpayer,sells service contracts

Q107: Pass-through entities are taxed at only one

Q109: Normally,a security dealer reports ordinary income on

Q115: Lars has a basis in his partnership

Q129: Nate and Nikki have three dependent children

Q130: Lewis,who is single,is claimed as a dependent

Q138: In 2012,Regina purchased a home in Las