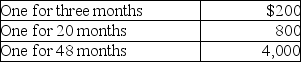

CT Computer Corporation,a cash-basis taxpayer,sells service contracts on the computers it sells.At the beginning of January of this year,CT Corporation sold contracts with service to begin immediately:

The amount of income CT Corporation must report for this year is

Definitions:

Inventory

The goods and materials that a business holds for the ultimate goal of resale or repair.

Depreciation

The gradual decrease in the economic value of the capital stock of a firm, nation, or other entity, either through physical wear and tear or obsolescence.

Net Investment

The total amount of investment in new capital assets minus the depreciation on existing assets, indicating growth in an economy's productive capacity.

Inventory Investment

The change in the stock of goods held by a business for resale or production over a period, part of the investment component in GDP calculation.

Q29: Under the wash sale rule,if all of

Q45: If a fully-taxable bond yields a BTROR

Q51: If a corporation reports both a NLTCG

Q63: Diane,a successful accountant with an annual income

Q63: Taxpayers often have to decide between contributing

Q82: Coretta sold the following securities during 2017:<br><img

Q100: During the current year,Nancy had the following

Q126: Suri,age 8,is a dependent of her parents

Q135: The following information for 2017 relates to

Q144: During the current year,Donna,a single taxpayer,reports the