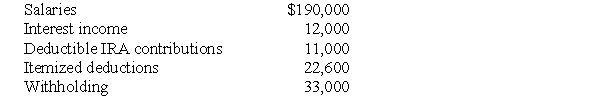

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2017.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax),rounded to the nearest dollar?

e.What is the amount of their tax due or (refund due)?

Definitions:

Gallup Surveys

Public opinion polls conducted by Gallup, a research-based, global performance-management consulting company.

Religious Services

Formalized periods of communal worship and rites practiced by members of a religious faith.

Bystander Effect

The social psychological phenomenon where people are less likely to help a victim when other people are present.

Social Trap

A situation in which a group of people act to obtain short-term individual gains, which in the long run leads to a loss for the group as a whole.

Q20: Randy and Sharon are married and have

Q38: Ken invests $10,000 in a deductible IRA

Q42: Punitive damages are taxable unless they are

Q44: Natasha is a single taxpayer with a

Q61: The AAA Partnership makes an election to

Q76: Thomas purchased an annuity for $20,000 that

Q90: A corporation's regular taxable income for the

Q120: When a partnership interest is sold,ordinary income

Q128: Members of a single family may be

Q137: Ron transfers assets with a $100,000 FMV