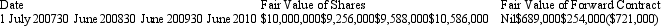

The following data is provided for the fair value of a share portfolio,and the fair value of a forward contract taken out on 1 July 2007 to 'hedge' movements in the fair value of the shares.Assume the hedge was highly effective at inception of the hedge.  Which of the following statements is true?

Which of the following statements is true?

Definitions:

Investing Activities

Transactions involving the purchase or sale of long-term assets and other investments not considered cash equivalents, usually reflected in the cash flow statement of a company.

Cash Dividends

Payments made by a corporation to its shareholders, usually in the form of cash, out of its profits or reserves.

Payable

Refers to an amount of money that a company owes to its creditors or suppliers, to be paid at a later date.

Accounts Receivable

Money owed to a business by its customers for goods or services delivered on credit.

Q2: If retained earnings decreased during the year,and

Q8: The bankruptcies of Enron and WorldCom both

Q15: AASB 124 requires a standard,detailed set of

Q23: If a financial report contains both the

Q25: The following diagram represents the ownership of

Q26: What is the purpose of the accrual

Q42: The guidelines to determine that a segment

Q52: Mop Ltd acquired a 40 per cent

Q56: On 1 July 2012,Felix Ltd acquires all

Q66: 'Significant influence' normally stems from the investor's